WHAT INCOTERMS YIELD

SHOULD I INCLUDE IN THE INVOICE?

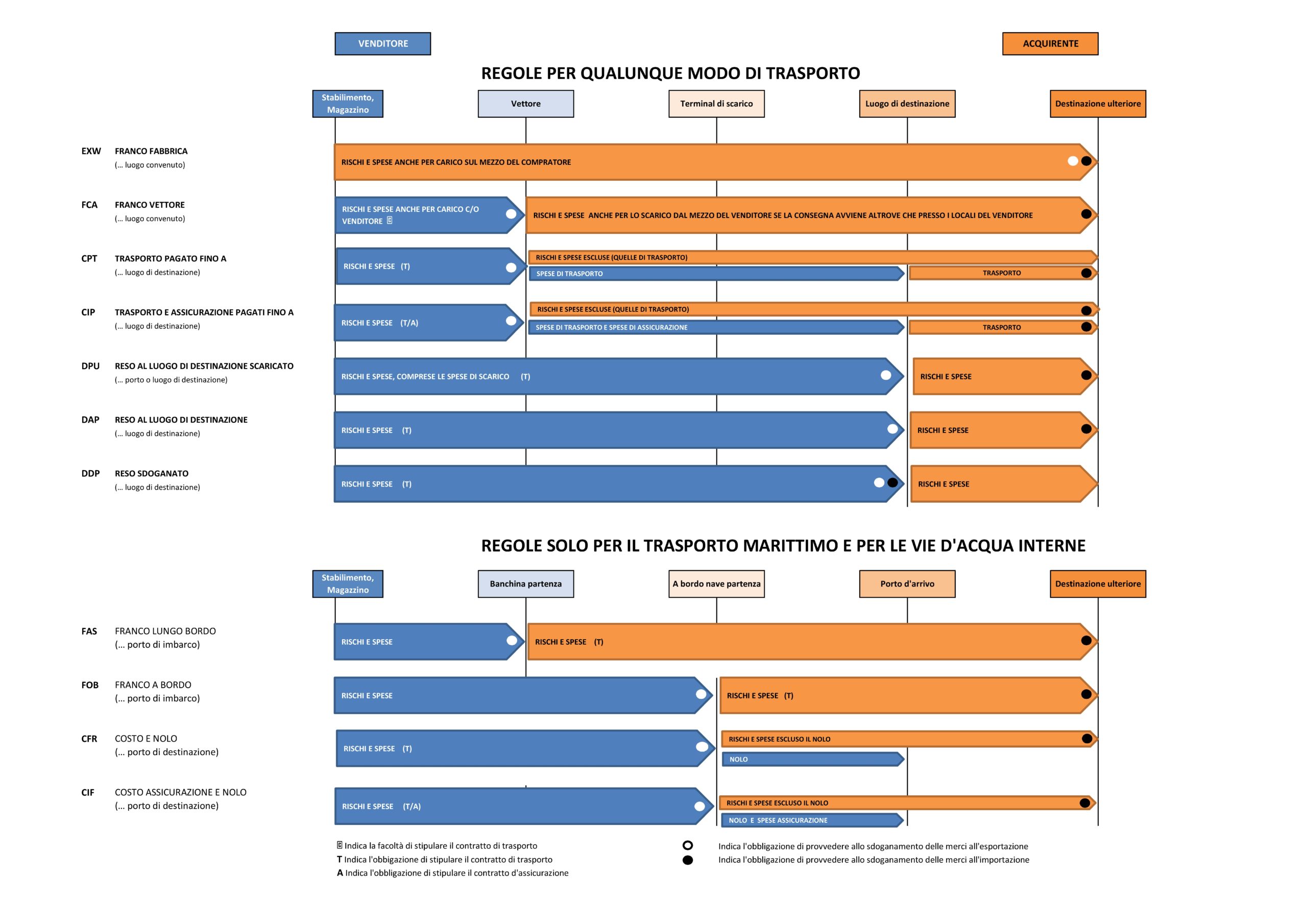

Each individual acronym encoded in Incoterms® clearly defines which Incoterms® yield to use and who should bear the costs and responsibilities for each part of transportation, customs costs on departure and arrival, and insurance costs. An important (often overlooked) part is the indication, after the abbreviation, of the specific name of the geographical location, border or port/airport to which the abbreviation refers.

Which Incoterms® yield to use and where can I find them? The Incoterms® terms were ratified by the International Chamber of Commerce (ICC) and originally published in English with authorized translations into 31 other languages by the various national chambers of commerce.

The agreement was last revised in 2020, hence the current correct name of INCOTERMS® 2020.

Which Incoterms® yield to use?

EXW

The term Ex Works, also known by the acronym EXW, is usually translated as Ex Works rendering. The EXW notation, which must be supplemented by the specific indication of a location, is one that simply binds the seller to prepare goods on his premises (factory, warehouse, etc.) on the agreed date, providing only the appropriate documentation for export from the nation of origin.

The buyer, for his part, will have to arrange for the customs export operation (if he is unable to do so, the return will have to be changed to FCA), arrange the transportation and pay all the costs, while also taking all the risks up to the final destination.

FCA

The term Free Carrier is usually translated as free shipper, derived from the term “free” (“free”) meaning with unpaid freight. The FCA notation, which must be supplemented by the specific indication of a location, is one that binds the seller to prepare goods on the agreed date by providing the appropriate documentation for export from the nation of origin, delivery at the warehouse of the freight forwarder (or other party chosen by the buyer), and payment of the costs related to the export customs operation.

The buyer, for his part, will arrange the transportation and pay all the costs, while also taking all the risks to the final destination.

FOB

The term Free On Board, also known by the acronym FOB, is usually used for maritime transportation. The FOB notation, which must be supplemented by the specific indication of the port of embarkation, binds the seller to all transportation costs to the port of embarkation, including any costs for putting the ship on board, as well as the costs of obtaining licenses and documentation for export from the nation of origin and those for customs operations always for export.

From the moment the goods are loaded aboard the ship, all other expenses are to be borne by the buyer, including insurance costs. As for the responsibility for the goods, this passes from the seller to the buyer when the goods are loaded on board the ship.

The wording of this surrender term is considered complete with the indication of the port of embarkation (e.g. FOB Genoa).

- Note: As of Incoterms® 2020, the term FOB is only recommended for maritime transport of non-containerized goods. For container transport, FCA is recommended.

FAS (maritime or inland waterways only)

The Free Alongside Ship (FAS) surrender, originated for sea transportation and stipulates that the seller is responsible for all transportation costs to the port of embarkation, including any costs for putting the goods along board the ship, as well as the costs of obtaining licenses and documentation for export from the nation of origin and those for customs operations always for export.

From the moment the goods are placed along board the ship, all other expenses are to be borne by the buyer, including insurance costs. As for the responsibility for the goods, this passes from the seller to the buyer when the goods are placed along board the ship.

The wording of this surrender term is considered complete with the indication of the port of embarkation (e.g. FAS Genoa).

- Note: As of Incoterms® 2020, the term FAS is only recommended for maritime transport of non-containerized goods. For container transport, FCA is recommended.

CFR

The term Cost and Freight, also known as CFR or C&F, is mainly used for maritime transport. Under this term, the seller is responsible for all transportation costs to the port of destination, including any costs for unloading the ship, as well as for obtaining licenses and documentation for export from the nation of origin and for customs operations always for export.

However, the risk of loss or damage of the goods passes from the buyer to the seller once the goods are loaded aboard the ship at the port of embarkation. The seller is not responsible for the cost of insuring goods during transportation.

The wording of this surrender term is considered complete with the indication of the destination port (e.g., CFR New York).

CIF

The term Cost, Insurance, and Freight, also known as CIF, is mainly used for maritime transportation. This term stipulates that the seller is responsible for all transportation costs to the port of destination, including the cost of insuring the goods during transport, as well as for obtaining licenses and documentation for export from the nation of origin and for customs operations always for export.

The risk of loss or damage to the goods passes from the buyer to the seller once the goods are loaded aboard the ship at the port of embarkation. However, the seller is also required to take out insurance in favor of the buyer to cover any loss or damage during transportation to the port of destination.

The wording of this surrender term is considered complete with the indication of the destination port (e.g., CIF New York).

CPT

The term Carriage Paid To, also known as CPT, is used for any mode of transportation, including multimodal transportation. Under this term, the seller is responsible for all transportation costs to the agreed upon place of destination, as well as for obtaining licenses and documentation for export from the nation of origin and for customs operations always for export.

The risk of loss or damage of the goods passes from the buyer to the seller once the goods are delivered to the first carrier. The seller is not responsible for the cost of insuring goods during transportation.

The wording of this term of surrender is considered complete with an indication of the agreed place of destination (e.g., CPT Paris).

CIP

The term Carriage and Insurance Paid To, also known as CIP, is used for any mode of transportation, including multimodal transportation. Under this term, the seller is responsible for all transportation costs to the agreed upon place of destination, including the cost of insuring the goods during transportation, as well as for obtaining licenses and documentation for export from the nation of origin and for customs operations always for export.

The risk of loss or damage of the goods passes from the buyer to the seller once the goods are delivered to the first carrier. However, the seller is also required to take out insurance for the benefit of the buyer to cover any loss or damage during transportation to the agreed destination.

The wording of this term of surrender is considered complete with an indication of the agreed place of destination (e.g., CIP Paris).

DAP

The term Delivered At Place, also known as DAP, is used for any mode of transportation, including multimodal transportation. Under this term, the seller is responsible for arranging transportation and delivery of the goods to the agreed place of destination, as well as for obtaining licenses and documentation for export from the nation of origin and for customs operations always for export.

The risk of loss or damage of the goods passes from the buyer to the seller once the goods are made available to the buyer at the agreed destination. The buyer is responsible for the import of goods, including customs costs and procedures.

The wording of this surrender term is considered complete with the indication of the agreed place of destination (e.g. DAP Milan).

DPU

The term Delivered At Place Unloaded, also known as DPU, is used for any mode of transportation, including multimodal transportation. Under this term, the seller is responsible for arranging transportation and delivery of the goods to the agreed place of destination, as well as for obtaining licenses and documentation for export from the nation of origin and for customs operations always for export.

The seller is also responsible for unloading the goods at the agreed destination. The risk of loss or damage of the goods passes from the buyer to the seller once the goods have been unloaded at the agreed destination. The buyer is responsible for the import of goods, including customs costs and procedures.

The wording of this term of surrender is considered complete with the indication of the agreed place of destination (e.g. DPU Munich).

DDP

The term Delivered Duty Paid, also known as DDP, is used for any mode of transportation, including multimodal transportation. Under this term, the seller is responsible for arranging transportation and delivery of the goods to the agreed place of destination, as well as for obtaining licenses and documentation for export from the nation of origin and for both export and import customs operations.

The seller is also responsible for the payment of duties, taxes, and any other charges related to the import of the goods into the destination nation. The risk of loss or damage of the goods passes from the buyer to the seller once the goods are made available to the buyer at the agreed destination.

The wording of this term of surrender is considered complete with an indication of the agreed place of destination (e.g. DDP Madrid).

In summary, Incoterms® 2020 terms provide a uniform and clear framework for establishing seller and buyer responsibilities and obligations in international trade. The choice of the appropriate Incoterm term will depend on the specific needs of the parties involved in the transaction and the mode of transportation used.

Conclusion

In conclusion, understanding and correctly using Incoterms® 2020 terms is critical to ensuring that international business transactions are clear and unambiguous for all parties involved. These standardized terms facilitate communication between sellers and buyers, reducing the risk of misunderstandings and disputes. It is important that companies engaged in international trade keep abreast of changes and revisions to Incoterms® terms and ensure that they use the current version in their contracts.

Remember that the choice of the most suitable Incoterm® term depends on the specific needs of the parties involved and the nature of the transaction. Therefore, it is advisable to consult a subject matter expert or a lawyer specializing in international law to determine which term is most appropriate for each situation.